Bitcoin was never the future of money. It was a battering ram in a regulatory war. Now that war is wrapping up, and the capital that built it is quietly leaving.

For 17 years we convinced ourselves that Magic Internet Money was the final state of finance. It was not. Bitcoin was a regulatory battering ram, a one purpose siege engine built to smash a specific wall: the state’s refusal to tolerate digital bearer assets.

That job is basically done. Tokenized US stocks are already being issued. Tokenized gold is legal and growing. Tokenized USD has a market cap of several hundred billion dollars.

In wartime, a battering ram is priceless. In peacetime, it is a heavy, expensive antique.

Now that the financial rails are being upgraded and legalized, the Gold 2.0 narrative is collapsing back into what we actually wanted in the 1990s: tokenized claims on real assets.

## I. PREHISTORY: E-GOLD

To understand why Bitcoin is becoming obsolete, you have to understand why it was built. It was not an immaculate conception. It emerged in the shadow of repeated attempts at digital money getting crushed in the same way.

In 1996, E-gold launched. By the mid 2000s it had roughly five million accounts and was processing billions. It proved something important. The world wanted digital bearer assets backed by hard value.

Then the state crushed it.

In December 2005, the FBI raided E-gold. In July 2008, the founder pled guilty. The message was clear. A centralized digital gold currency is trivial to destroy. Knock on one door, seize one server, indict one human, and it is over.

Three months later, in October 2008, Satoshi published the Bitcoin whitepaper. He had already spent years thinking about these problems. In his own writing he said the root flaw of traditional and earlier digital money was how much trust it demanded in central banks and commercial banks. Experiments like E-gold showed how easy it was to attack those trust points.

Satoshi had just watched a real innovation in digital money get decapitated. If you want digital bearer assets to survive, you cannot make it possible to kill them by knocking on one door.

Bitcoin was engineered specifically to remove the attack vectors that killed E-gold. It was not built for efficiency. It was built for survivability.

## II. THE WAR: THE NECESSARY DELUSION

In the early days, onboarding someone into Bitcoin was almost a magic trick. We would tell people to download a wallet on their phone. When the first coins arrived, you could see the realization hit. They had just opened a financial account and received value instantly, with no permission, no paperwork, and no regulator.

It was a slap in the face. The banking system suddenly looked archaic. You felt how repressed you had been without even knowing it.

At Money 20/20 in Las Vegas, a speaker put a QR code on a giant screen and ran a live Bitcoin lottery. The audience sent bitcoins and created a jackpot in real time. A TradFi guy next to me leaned over and said the speaker had just broken about fifteen laws. He was probably right. Nobody cared. That was the point.

This wasn't just finance; it was rebellion. A post that hit #1 on the Bitcoin Reddit in the early days captured the sentiment perfectly: buy Bitcoin because "It is a f--- you to those crooks and robbers who would middle themselves to feed on my hard earned work."

The bootstrapping mechanism was perfect. By fighting for the cause, posting, shilling, arguing, and onboarding, you directly increased the value of the coins in your own wallet and your friends’ wallets. The rebellion paid you.

Because the network could not be shut down, it kept growing after every crackdown and every bit of bad press. Over time, everyone started to act as if Magic Internet Money was the actual destination rather than a hack.

The delusion got so strong that the establishment started to play along. BlackRock filed for ETFs. The US president discussed holding Bitcoin as a reserve asset. Pension funds and universities bought exposure. Michael Saylor convinced convertible debt buyers and shareholders to fund tens of billions of corporate Bitcoin purchases. Mining scaled until its power draw rivaled mid-size nations.

Finally, with over half of campaign finance money coming from crypto, the demands to legalize the rails were heard. The irony is simple. The government’s own heavy handed crackdown on banks and payment processors helped create a three trillion dollar battering ram that forced them to capitulate.

## III. THE ROUT: WHEN WINNING KILLED THE TRADE

RAILS UPGRADED, MONOPOLY BROKEN

Bitcoin’s edge was never just censorship resistance. It was monopoly.

For many years, if you wanted tokenized bearer value, Bitcoin was the only game in town. Accounts were being closed. Fintechs were terrified of regulators. If you wanted the benefits of instant, programmable money, you had to swallow the whole Bitcoin package.

So we did. We loved it and supported it because there was nothing else.

That era is over.

You can see what happens once there is more than one usable rail by watching Tether. USDT started on Bitcoin rails, then most of the float migrated to Ethereum when that was cheaper and more usable. When Ethereum gas fees exploded, retail and emerging markets pushed issuance onto Tron. Same dollars, same issuer, different pipe.

Stablecoins are not loyal to any chain. They treat blockchains as disposable plumbing. The asset and the issuer are what matter; the rail is just a mix of fee schedule, reliability, and connectivity to the rest of the system. In that sense, the “Blockchain not Bitcoin” crowd actually won.

Horse drawn cars were widely shared in the early days to mock bank reports on blockchain technology

Once you understand that, Bitcoin’s position looks very different. When there is only one working rail, everything is forced to sit on it and you can confuse the value of the asset with the value of the pipe. When there are many rails, the value just slides to whatever is cheapest and best connected.

That is where we are now. Most of the world’s population outside the US can now own tokenized claims on US equities. Perpetual futures that used to be a killer app for crypto are being cloned onshore by venues like the CME. Banks are starting to enable USDT deposits and withdrawals. Coinbase is progressing toward being a combined bank and brokerage account where you can wire funds, write checks, and buy equities next to your crypto. The network effects that once protected Bitcoin’s monopoly are dissolving into generic plumbing.

Once the monopoly goes, Bitcoin stops being the only way to get the benefit. It becomes one product competing against regulated, high quality offerings that sit much closer to what people actually wanted in the first place.

TECHNICAL REALITY CHECK

During the war, we ignored a simple fact. Bitcoin is a bad payment system.

We still scan QR codes and paste long strings of nonsense to move value. There are no standardized usernames. Moving value across layers and chains is an obstacle course. Lose track of which address is which and you burn money forever.

"money of the future"

By 2017, fees to send Bitcoin spiked near one hundred dollars. The Bitcoin cafe in Prague had to accept Litecoin just to keep operating. I had a dinner in Las Vegas where it took thirty minutes to pay the bill with Bitcoin as people fumbled with phone wallets and stuck transactions.

Even today, wallets routinely fail in basic ways. Balances do not show up. Transactions hang. People send funds to wrong addresses and vaporize them. In the early days almost everyone who was gifted coins lost them. I personally managed to delete over one thousand Bitcoins. This is normal in crypto land.

Pure onchain finance is terrifying to use at scale. People click “sign” on blobs in a browser that they cannot read and do not understand. Sophisticated operations like Bybit can still get hacked for a billion dollars with no meaningful recourse.

We told ourselves these UX problems were temporary growing pains. A decade later, the real UX improvement was not some elegant protocol. It was centralized custodians. They gave people passwords, account recovery, and fiat on-ramps.

On a technical level, that is the punchline. Bitcoin never learned how to be usable without recreating the very intermediaries it claimed to replace.

THE TRADE IS NO LONGER WORTH THE RISK

Once the rails improved elsewhere, all that was left was the trade.

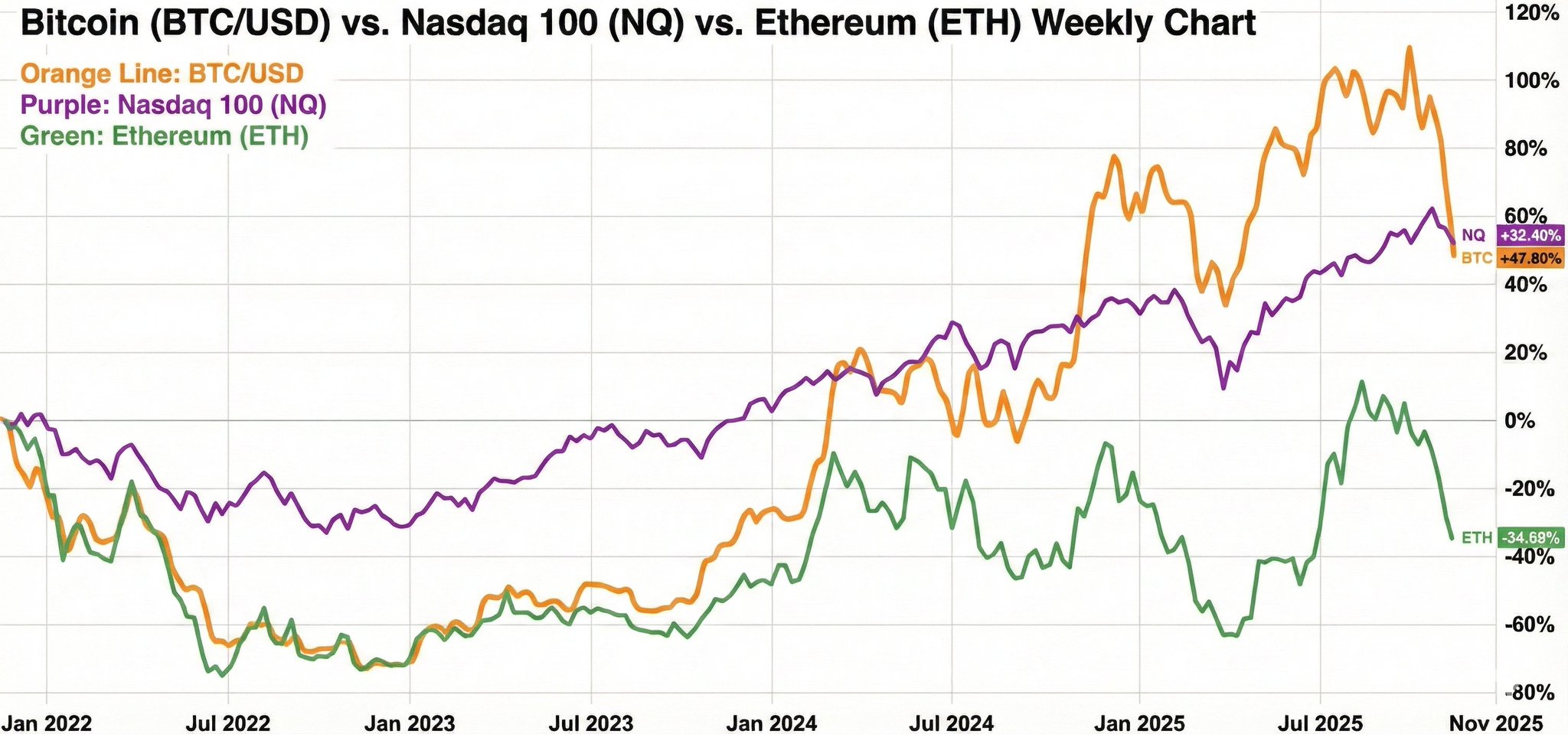

Look at the returns over one full crypto cycle, exactly four years back. The Nasdaq is beating Bitcoin. You took existential regulatory risk, accepted savage drawdowns, lived with constant hacks and exchange collapses, and your reward was underperformance of a plain tech index. The risk premium has vanished.

The picture is worse for Ethereum. The part of the stack that was supposed to pay you the most for taking risk has been a straight tax on performance, while the boring index line just grinds up.

Part of the reason is structural. There is a huge cohort of original holders whose entire net worth is in crypto. They are older now. They have families, real expenses, and a normal desire to de-risk. They sell coins every month to fund normal rich person life. Across tens of thousands of holders, that is billions a month of lifestyle selling.

The new inflows are a different animal. ETF buyers and wealth managers are mostly doing one percent or two percent allocations as a box checking exercise. That money is sticky, but it is not aggressive. Those modest allocations have to fight against relentless OG selling, plus exchange fees, plus mining issuance, plus scam tokens and hacks, just to keep the price from going down.

The regime of massive alpha for taking the regulatory bullet is gone.

BUILDERS SMELL STAGNATION

Builders are not stupid. They can smell when tech loses its edge. Developer activity has plunged down to 2017 levels.

Weekly developer commits across all ecosystems

At the same time, the codebase effectively ossified. Changing a decentralized system is hard by design. Ambitious engineers who once saw crypto as the edge have drifted to robotics, space, AI, and other domains where they can do something more exciting than just shuffling digits.

If the trade is bad, the UX is worse, and the talent is leaving, the forward path is not hard to see.

## IV. ERROR CORRECTION BEATS PURE DECENTRALIZATION

The decentralization cult told a simple story. Code is law. Uncensorable money. No one can stop a transaction or reverse it.

Most people do not actually want that. They want rails that work, and they want someone to fix things when they go wrong.

You can see this in how people treat Tether. When funds are stolen by North Korean hackers, Tether is willing to freeze those balances. When someone sends a large amount of USDT to a contract or burn address by mistake, can still sign from the original wallet, clears KYC, and pays the fee, Tether will blacklist the stuck tokens and mint replacements to the correct address. There is paperwork and delay, but there is a process. There is a human layer that can admit a mistake and repair it.

That is counterparty risk, but it is the kind people value. If you lose money through a technical screwup or get hit in a hack, there is at least a chance of recovery. With onchain Bitcoin, there is none. If you mispaste an address or sign the wrong transaction, the loss is permanent. No appeal, no help desk, no second chance.

We built our entire legal system around the opposite intuition. Courts have appeals. Judges can vacate verdicts. Governors and presidents can pardon. Bankruptcy exists so one bad decision does not destroy a life forever. We like living in a world where obvious errors can be unwound. No one actually wants a system where a bug like the Parity multisig exploit can freeze $150m of Polkadot’s treasury and leave everyone shrugging that “code is law.”

We also trust the issuers more than we did in the early days. Back then, “regulation” meant early crypto businesses losing their bank accounts because the bank was terrified of the regulator pulling its banking license. More recently we watched entire crypto friendly banks taken out in a weekend. The state felt like an executioner, not a referee. Today, the same regulatory apparatus is the safety net. It forces disclosures, boxes issuers into audited structures, and gives politicians and courts hooks to punish outright theft. Crypto money and political power are now intertwined enough that regulators cannot casually nuke the whole space; they have to domesticate it. That makes living with issuer and regulator risk feel a lot saner than living in a world where one lost seed phrase or malicious signature prompt can wipe you out with no recourse.

Nobody really wanted a totally unregulated financial system. Ten years ago, a broken regulated system made unregulated chaos look attractive by comparison. But as the regulated rails modernize and add features, that bargain flips. The revealed preference is clear. People want powerful rails, but they also want a referee on the field.

## V. FROM MAGIC INTERNET MONEY TO TOKENIZED REAL ASSETS

Bitcoin did its job. It was the battering ram that smashed through the wall that stopped E-gold and every similar attempt. It made it politically and socially impossible to ban tokenized assets forever. But that victory creates a paradox. When the system finally agrees to upgrade, the high value of the battering ram collapses.

Crypto still has a role. But we no longer need a three trillion dollar rebel army.. A skeleton crew of 11 people at Hyperliquid can prototype features and force regulators to respond. When something works in the sandbox, TradFi will clone it with a regulatory wrapper.

The main trade is no longer to put a huge chunk of your net worth into Magic Internet Money for a decade and hope. That only made sense when the rails were broken and the upside was obviously enormous. Magic Internet Money was always a strange compromise: pristine rails wrapped around assets backed by nothing but a story. In later pieces we will look at what happens when those same rails carry claims on things that are actually scarce in the real world.

Capital is already adjusting. Even crypto’s unofficial central bank is shifting. Tether holds more gold on its balance sheet than Bitcoin. Tokenized gold and other real world assets are growing fast.

The era of Magic Internet Money is ending. The era of tokenized real assets is beginning. Now that the door is open, we can stop worshipping the battering ram and start paying attention to the assets and trades that will actually matter on the other side.